Valentine’s Day isn’t just about hearts and flowers. It’s a pivotal moment for financial services companies to deepen connections with their customers. In this digital age, leveraging messaging and CPaaS (Communications Platform as a Service) tools holds immense significance for these companies. Here are 7 reasons why integrating these tools are essential for financial institutions looking to seize the opportunities presented by Valentine’s Day.

Personalized Engagement

Valentine’s Day is all about celebrating relationships. For financial service providers, this means an opportunity to engage on a personal level. Messaging platforms allow tailored communications, enabling companies to send personalized messages, offers, and tips that resonate with individual customers’ financial needs, goals, and preferences. CPaaS tools enhance this by providing channels like SMS, emails, and chatbots, facilitating direct, real-time conversations to address customer inquiries or offer assistance promptly.

Building Customer Trust and Loyalty

A thoughtful message or a personalized offer can go a long way in fostering trust and loyalty. By leveraging messaging tools, financial companies can reinforce their commitment to their customers’ financial well-being. For instance, sending a message with advice on managing expenses during the holiday or offering exclusive Valentine’s Day deals showcases a company’s dedication to its customers’ financial success, nurturing a stronger bond.

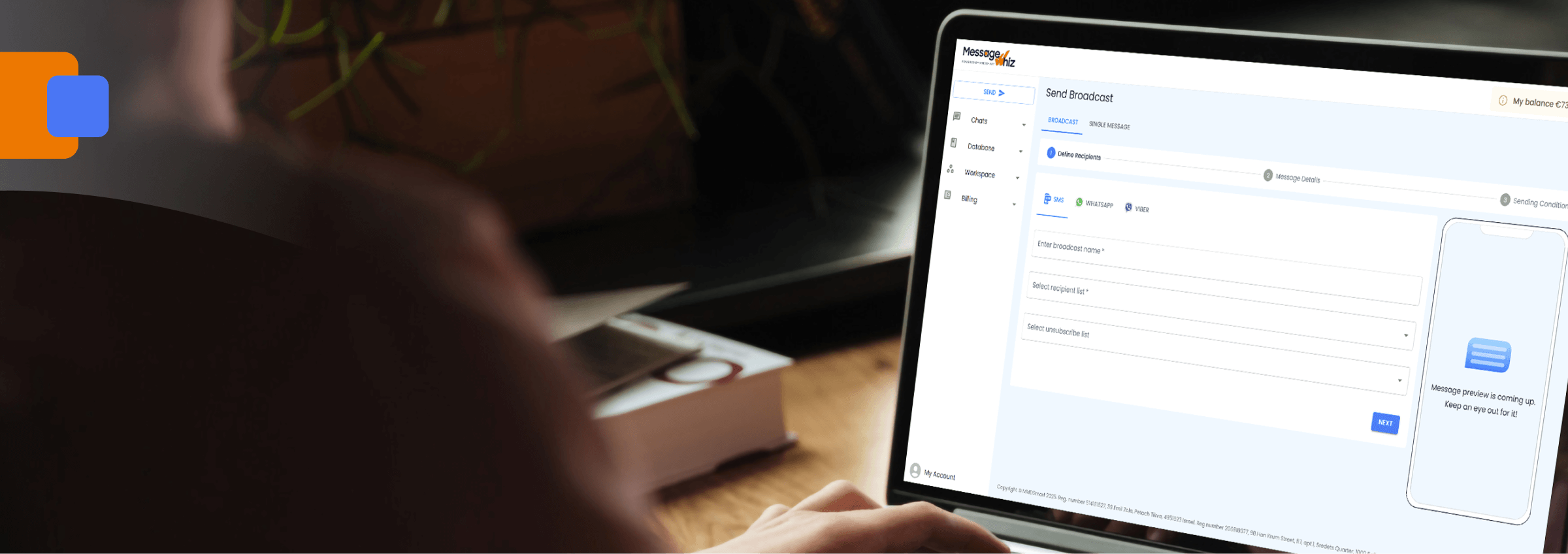

Seamless Transactional Experience

CPaaS tools play a pivotal role in ensuring a seamless transactional experience. With secure and efficient messaging integrations, financial institutions can send transaction alerts, reminders for upcoming payments, or even provide quick links for hassle-free bill payments—all contributing to a smoother and more convenient financial experience for customers during a busy time like Valentine’s Day.

Capitalizing on Seasonal Opportunities

Valentine’s Day represents a significant spending occasion. Financial services companies can leverage this by using messaging and CPaaS tools to offer targeted promotions, such as special credit card rewards for dining or gifts, enticing loan offers for home improvements, or investment opportunities for future financial security. These tailored promotions can drive engagement and potentially increase revenue during this period.

Strengthening Brand Image

A company’s responsiveness and ability to connect with customers on special occasions can significantly impact its brand image. Utilizing messaging tools to express gratitude, share heartfelt messages, or simply wish customers a happy Valentine’s Day can humanize the brand, making it more relatable and compassionate in the eyes of its clientele.

Data-Driven Insights

Messaging and CPaaS tools provide invaluable data on customer behavior, preferences, and interactions. Analyzing this data can help financial companies understand their customers better, enabling them to refine their strategies, personalize offerings, and optimize communication channels for improved engagement and conversion rates.

Regulatory Compliance and Security

In the finance sector, compliance and security are non-negotiable. Messaging and CPaaS tools equipped with robust security measures ensure compliance with industry regulations like GDPR and PCI-DSS. By choosing reliable platforms, financial institutions can maintain the confidentiality and integrity of customer information while adhering to regulatory standards.

Valentine’s Day is for Financial Services Companies Too

Valentine’s Day isn’t just an occasion for romantic gestures; it’s a prime opportunity for financial services companies to strengthen relationships with their customers. Messaging and CPaaS tools serve as indispensable assets, empowering these companies to deliver personalized, timely, and secure communication. By leveraging these tools effectively, financial institutions can not only enhance customer engagement but also fortify their brand image and drive business growth. As we navigate the digital landscape, embracing these technologies is not just an option—it’s a necessity for those aiming to thrive in today’s competitive financial market.