As we head into 2024, experts from Deloitte Insights have shared their expectations of some significant changes in the industry. In this blog, we’ll take a look at some of the trends they are looking at, and see where tools like messaging and unified communications can help financial services companies as they navigate these challenges.

Technological Turbulence

There are a number of technological changes impacting the financial services industry. Banks are moving toward cloud services, and Generative AI is expected to impact financial services. Generative AI has led to increased phishing attacks around the world, as cybercriminals use the technology to manipulate customers into handing over their account login credentials.

At the same time, the transition to the cloud can exacerbate identity and access issues. After successfully completing a phishing attack with generative AI, cybercriminals can use cloud login points to access accounts and transfer funds into their own accounts.

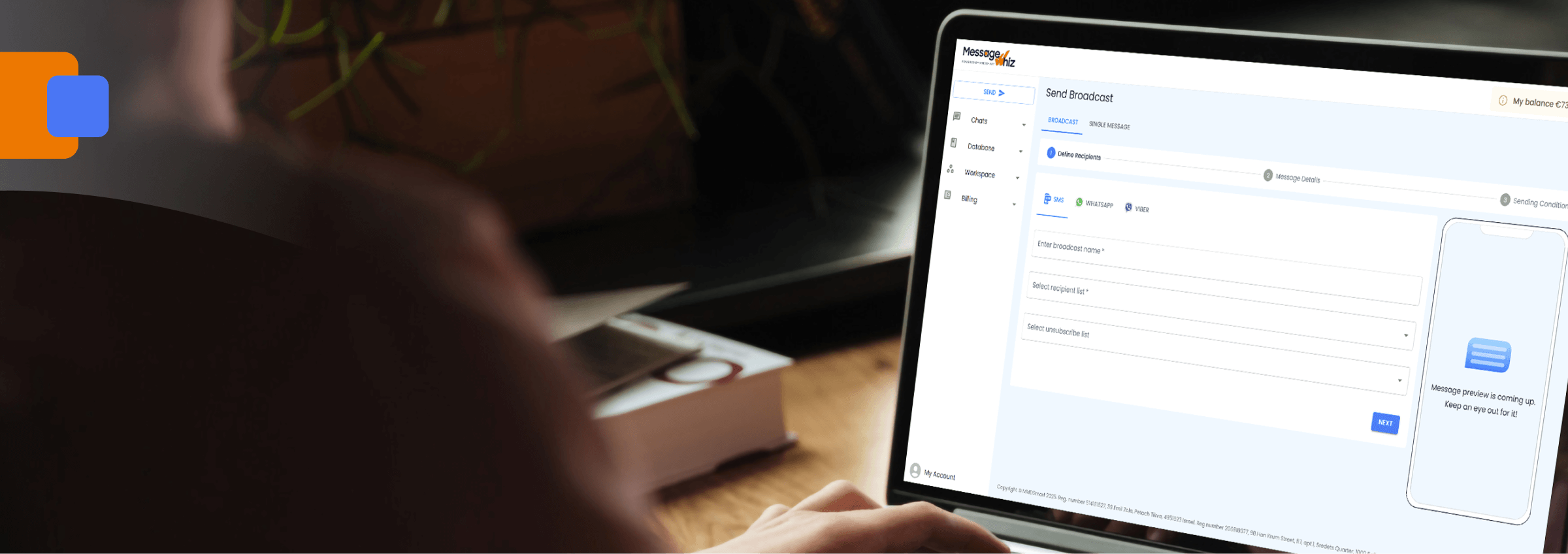

Messaging can play a key role in preventing these types of crimes. Multi-factor authentication (MFA), where a user receives a one-time password (OTP) over the messaging platform of their choice, can secure accounts even when threat actors already have access credentials. Even if the criminal tries to log into the account, they will be denied access without the OTP.

Regulatory Pressure is Coming to Cryptocurrencies

In 2023 the European Union released its Markets in Crypto-Assets (MiCA) regulations. While the regulations cover a number of areas, one area of concern is transparency in markets and disclosure to the public.

Cryptocurrency issuers must have transparent procedures to share information and handle complaints. Tools like CPaaS (Communication Platform as a Service), which provide a unified, cloud-based voice and text platform, can be instrumental as a transparent communication channel that is accessible to customers across the European Union and around the world.

High Interest Rates are Coming

Experts are predicting higher interest rates in the coming year. While this is unwelcome news in many areas, financial services customers can turn this into an opportunity.

Financial institutions can use messaging tools to reach targeted customers that are in a financial position to take advantage of high rates. Those sitting on large cash accounts can be targeted through messaging or CPaaS platforms and offered high-yield investment instruments. The financial institutions can use the communication channel to promote the service, share updates in any paperwork, and share account information.

Demographic Shifts Require a New Way of Communication

Demographic shifts are showing an increase in younger customers, as well as a growing middle class in emerging markets. Tomorrow’s winners in the financial services game will be those firms capable of reaching a larger segment of this market.

Messaging is ideal for this type of activity. Studies have shown that younger people overwhelmingly prefer to message – rather than talk to or email – their service providers. Adopting a unified platform that integrates with a CRM system creates a powerful combination of sending the right message over the right channel.

Sustainability it Increasingly Important

Banks will continue to look for opportunities to reduce their carbon footprint. Shifting communication away from expensive and carbon-negative paper products and replacing it with low-carbon text messages is a win for all parties involved.

Learn More About Messaging in the Financial Services Arena

These trends are expected to shape the financial services industry in the coming years, and firms that are able to adapt to these changes will be better positioned to succeed. To learn more about the way you can integrate messaging into your communications channels, download our Financial Services Messaging Whitepaper. Read about today’s leading use cases and the organizational benefits messaging has to offer.